The Ultimate Toolkit for Scaling Operations in Growing Companies

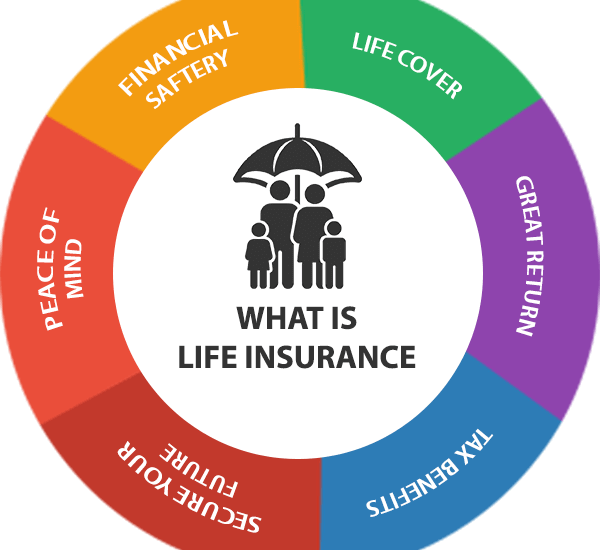

Business insurance is an essential part of protecting your small business from unexpected risks and liabilities. Whether you’re just starting out or have been running your venture for years, the right insurance coverage can ensure that your operations remain secure and sustainable. From safeguarding your assets to covering potential damages or losses, having the appropriate small business insurance can be a game-changer, allowing you to focus on growth without undue worry about unforeseen challenges. Let’s explore the importance, types, and benefits of business insurance, and how it applies specifically to small businesses.

Toc

Why Business Insurance Matters for Small Businesses

Small businesses often work with tight budgets and limited resources, which means that any unexpected event—such as a lawsuit, property damage, or employee injury—could have devastating financial consequences. Business insurance acts as a vital safety net, providing protection for business owners against these risks and giving them the security to focus on growing their business. Here’s why business insurance is so essential for small businesses:

1. Protecting Business Assets

Think about what would happen if your office or storefront were damaged by a fire, flood, or other natural disaster. Without proper insurance, replacing essential equipment, repairing the damaged space, or even temporarily relocating your operations could quickly drain your finances, potentially putting your business at risk of closure. Business property insurance helps cover these costs, including equipment repairs or replacements, so you can get back to work faster and minimize downtime. Even smaller incidents, like theft or vandalism, can lead to significant costs, but property insurance ensures you’re financially prepared for the unexpected.

2. Mitigating Lawsuit Risks

Lawsuits are an unfortunate reality for many small business owners today. Whether it’s a customer injury on your premises, allegations of negligence, or a contractual dispute, legal battles can be incredibly costly and time-consuming. Liability insurance, which is one of the most important aspects of small business insurance, can cover legal fees, settlements, and other court-related costs, helping protect your finances. Beyond the financial protection, having liability insurance can also give you peace of mind, knowing you’re ready to handle any claims that might arise. For businesses that work directly with clients, professional liability insurance can also help safeguard you from claims of errors or unsatisfactory work.

3. Ensuring Employee Protection

Your employees are one of your most valuable assets, and protecting their well-being is not only a legal responsibility but also a moral one. If a team member is injured while on the job or suffers from work-related health issues, you’ll be responsible for covering their medical expenses, rehabilitation costs, and any lost wages during their recovery period. Workers’ compensation insurance, which is mandatory in most states, ensures that your employees are taken care of when accidents happen. It also protects your business from financial strain, as it can help cover these costs without putting your business at risk. In addition, demonstrating that you prioritize employee safety and security can help build trust with your workforce and strengthen your reputation as an employer.

By investing in comprehensive business insurance, small business owners can not only safeguard their operations but also gain peace of mind, knowing they are prepared for the unexpected. Whether it’s protecting your physical assets, mitigating legal risks, or ensuring your employees are covered, insurance is an essential tool for any small business looking to build a stable and successful future.

Types of Business Insurance Small Businesses Need

Understanding the different types of business insurance available is vital to choosing the right coverage for your company. Proper insurance protects your business from unexpected risks and ensures you can focus on growth with peace of mind. Here are some of the most common insurance policies small businesses should consider:

General Liability Insurance

General liability insurance covers costs related to third-party property damage, bodily injury, and claims of advertising or reputational harm. It’s one of the most basic and critical coverage options for any small business, providing protection from a wide range of potential issues that could otherwise lead to financial instability.

1. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

2. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

3. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

4. https://dalatfarmer.vn/mmoga-a-comprehensive-guide-to-small-business-insurance/

5. https://dalatfarmer.vn/mmoga-comprehensive-guide-to-finding-the-best-business-insurance-near-me/

Why General Liability Is the Foundation

General liability is particularly important for small businesses that regularly interact with customers, vendors, or other external parties. Whether it’s an accidental slip-and-fall in your store or a misunderstanding related to your advertising, this insurance can prevent a single incident from jeopardizing your financial stability. Without it, legal fees or settlement costs could overwhelm your budget, forcing you to dip into business funds or even personal savings.

Industries That Benefit the Most

Retail shops, construction companies, and professional services firms are among the small businesses that often prioritize general liability insurance. These industries face higher exposure to customer-facing risks, such as physical injuries on-site or disputes over completed work. For businesses offering products, general liability can also cover claims of product-related injuries or damages, ensuring comprehensive protection against potential lawsuits.

How to Choose the Best Business Insurance for Your Small Business

Property Insurance

Business property insurance is a cornerstone of protecting your company’s physical assets, ensuring that your operations can continue smoothly even when unexpected events arise. This coverage includes safeguarding your building (if you own it), office furniture, equipment, inventory, and other critical elements essential to your business operations. Whether you’re running a retail store with a large inventory or a technology company with expensive hardware and tools, property insurance provides the security you need to protect your investment and keep your business functioning. Without it, even a minor incident could disrupt your business and lead to significant financial losses.

What Property Insurance Covers

Property insurance is designed to cover a range of risks that could damage or destroy your business assets. Commonly covered events include fire, theft, vandalism, and natural disasters such as storms and hurricanes. For example, if a fire destroys a portion of your office or inventory, your policy would help cover the costs of repairing or replacing the damaged property.

Additionally, many policies offer optional coverage to provide extra protection based on your business’s unique needs. For instance, some policies include off-site property protection, ensuring assets such as laptops or equipment used remotely are covered. Others address damages caused by electrical surges, which can be especially important for businesses relying heavily on electronics. If your business is located in an area prone to floods or earthquakes, you may need to look for more comprehensive policies that specifically address these risks, as they are often excluded from standard coverage.

Tips for Choosing Property Insurance

Choosing the right property insurance requires careful consideration of your business’s value and unique risks. Start by assessing the full replacement value of your machinery, inventory, and other critical assets to avoid being underinsured. Underinsurance can leave you covering a significant portion of the costs yourself if disaster strikes.

When comparing policies, it’s also worth looking for those that include business interruption coverage. This feature helps cover lost income and operational expenses when your business experiences downtime due to an insured event. For example, if a fire damages your office space and you’re unable to operate for weeks, business interruption insurance ensures you can continue paying your employees and meeting essential expenses, minimizing the financial impact of the interruption.

Selecting the right policy may feel overwhelming, but by evaluating your specific needs and consulting with knowledgeable insurance providers, you can make a well-informed decision to protect your business effectively.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is tailored for businesses and professionals who provide specialized advice or services. This type of insurance protects against claims of negligence, mistakes, or errors in your work that result in financial loss for a client. Regardless of how experienced or careful you are, there’s always a chance that something could go wrong. E&O insurance acts as a safety net, ensuring that your business is protected if a client accuses you of causing harm through your services.

Who Needs E&O Insurance?

Professional liability insurance is essential for any business or individual offering expertise as part of their services. Industries that commonly rely on E&O insurance include consultants, accountants, marketing agencies, graphic designers, architects, and technology firms. For example, if an accountant makes an error in a client’s financial records that results in penalties, or if a marketing agency’s campaign fails to meet objectives, these professionals could face costly claims for the client’s financial losses.

Even if a client’s claim is unfounded, legal defense costs can add up quickly. E&O insurance covers legal fees, court costs, settlements, and any damages awarded, ensuring that your business isn’t burdened by the financial strain of a lawsuit.

1. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

2. https://dalatfarmer.vn/mmoga-a-comprehensive-guide-to-small-business-insurance/

3. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

4. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

5. https://dalatfarmer.vn/mmoga-comprehensive-guide-to-finding-the-best-business-insurance-near-me/

Key Features of Professional Liability

When choosing professional liability insurance, it’s important to look for a policy that addresses the risks specific to your industry. For example, technology businesses may need coverage for software errors, data breaches, or system failures, while legal professionals might require protection against missed deadlines or incorrect legal advice. Similarly, creative professionals in marketing or design benefit from coverage that addresses issues such as campaign errors or deliverable disputes, which could lead to financial losses for their clients.

Additional Benefits of Professional Liability

Beyond its financial protections, professional liability insurance can also enhance your credibility with clients. Many clients view this coverage as a sign of professionalism and reliability, offering them extra confidence in your ability to deliver high-quality work. Additionally, some contracts and agreements require businesses to carry professional liability insurance, making it not only a safeguard but also a valuable asset for securing partnerships.

Assess Your Business Risks

To ensure your small business is fully protected, it’s important to understand the key types of insurance available—general liability, property insurance, and professional liability—and how they work together to manage risks. Each policy serves a unique purpose, and when combined, they create a comprehensive safety net for your business.

Start by identifying the main risks your business faces. For instance, are you likely to experience supply chain disruptions, property damage, customer injuries, or intellectual property disputes? A thorough risk assessment will provide clarity on which types of coverage are most relevant to your operations. For example, a manufacturing business might prioritize equipment coverage, while a consultancy firm would focus more on professional liability and data protection.

Compare Insurance Providers

Not all insurance providers offer the same level of service, customization, or claims support. Comparing quotes from multiple providers is crucial, but don’t focus solely on price. Instead, carefully review what each policy covers and ensure it aligns with your business’s needs. Look for insurers with positive reviews, a reputation for responsive claims handling, and a track record of supporting small businesses.

Bundle Insurance Policies

To save on costs and simplify your insurance management, consider bundling policies. Many insurers offer packages tailored to small businesses, combining essential coverages like general liability, property insurance, and business interruption coverage. Bundling policies often leads to significant cost savings while ensuring you have the comprehensive protection your business requires.

By taking the time to evaluate your risks, compare providers, and select the right policies, you can build a strong foundation for your business’s risk management strategy, ensuring you’re prepared to face any challenges that come your way.

The Long-Term Benefits of Business Insurance

Beyond providing protection, having the right business insurance also gives small business owners peace of mind. It’s more than just a safety net—it’s a tool that allows you to plan for the future with confidence. Knowing that your assets, employees, and operations are safeguarded means you can dedicate your energy to scaling your business and pursuing new opportunities without worrying about unexpected setbacks. Additionally, having insurance in place can enhance your business’s credibility. Clients, partners, and even potential investors are more likely to trust and work with a company that demonstrates responsibility by protecting itself and others with appropriate coverage.

Investing in business insurance is a proactive approach to success, one that prepares you for the unexpected. While it may seem like an additional expense, it’s an essential safeguard that can spell the difference between bouncing back after a disaster or being forced to close your doors. From natural disasters and theft to legal liabilities, the right coverage can protect your business from financial ruin. Ultimately, the value of small business insurance is immeasurable—it’s about safeguarding your hard work, protecting your employees, and building a resilient foundation for long-term growth and success. It’s a key element of responsible business ownership that ensures you’re ready for whatever challenges come your way.