Comprehensive Guide to Finding the Best Business Insurance Near Me

When you’re searching for business insurance near me, it’s essential to understand the wide array of factors involved in selecting the right coverage. Business insurance protects your company’s assets, employees, and operations from potential risks, ensuring a safety net when unforeseen challenges arise. This guide dives deeply into what business insurance is, the types of policies available, and tips for finding the best insurance provider near you.

Toc

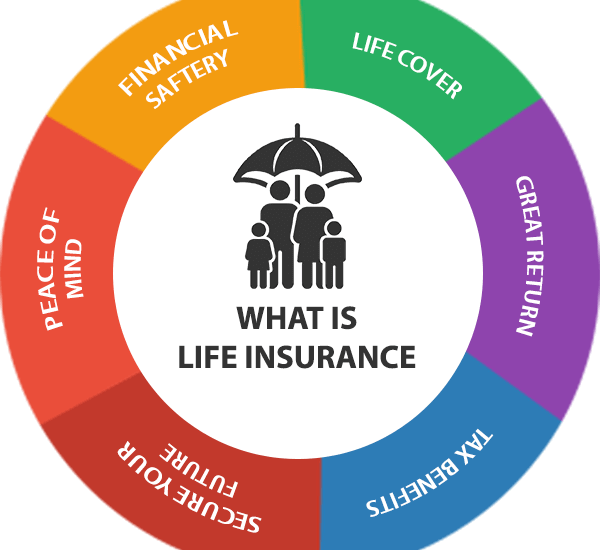

What Is Business Insurance and Why Do You Need It?

Business insurance is a broad term that encompasses various types of policies designed to cover different risks faced by businesses. Every business, whether it’s a small local shop or a multinational corporation, encounters risks that could lead to financial losses. Having the right insurance in place is essential to protect against these uncertainties, from accidents and lawsuits to natural disasters and cyber threats. Business insurance not only safeguards your assets but also ensures the continuity of your operations in the face of adversity.

Benefits of Business Insurance

- Financial Protection

Business insurance helps reduce the financial burden caused by unexpected events such as theft, property damage, or liability claims. For instance, if a fire damages your storefront or an employee accidentally injures a customer, insurance can cover the associated costs, helping you avoid out-of-pocket expenses. Without insurance, these unexpected incidents could result in severe losses that might even jeopardize the survival of your business.

- Legal Compliance

Depending on your location and industry, certain types of business insurance may be required by law. For example, worker’s compensation insurance is mandatory in many states to provide medical and wage benefits to employees who are injured or become ill on the job. Similarly, auto insurance is required for company-owned vehicles. Meeting these legal requirements not only keeps your business compliant but also avoids costly penalties and potential legal issues.

- Peace of Mind

Having the right insurance coverage gives business owners the confidence to focus on growing their operations without constantly worrying about potential risks. Whether it’s knowing you’re protected from costly lawsuits or that your employees are covered in case of accidents, insurance provides a safety net that allows you to direct your energy toward making your business thrive.

Common Risks Businesses Face

Businesses of all sizes and industries face a variety of challenges and risks. These risks can arise from external factors beyond your control or from day-to-day operations. For example:

- Property Damage: Fires, floods, storms, or vandalism can damage your premises or equipment, leading to costly repairs or replacements.

- Liability Lawsuits: Customers or clients could file lawsuits against your business due to accidents, errors, or product-related issues. Legal fees and settlements can quickly become overwhelming without liability coverage.

- Cyberattacks: In today’s digital world, businesses are increasingly targeted by hackers. A data breach or ransomware attack could disrupt operations and result in significant financial losses or reputational damage.

- Business Interruptions: Events like natural disasters or supply chain disruptions can halt your operations, causing revenue loss. Insurance can help cover these losses and get you back on track more quickly.

Identifying these risks and understanding your business’s unique vulnerabilities is the first step toward selecting the right coverage. Working with an experienced insurance provider ensures you customize a plan that aligns with your specific needs, offering comprehensive protection.

In a world full of uncertainties, business insurance is not just a safety net—it’s an investment in the future of your company.

Types of Business Insurance to Consider

When searching for “business insurance near me,” it’s important to familiarize yourself with the various types of coverage available. Business insurance is not one-size-fits-all — each policy is designed to address specific aspects of your business, helping you protect your assets, employees, and overall operations. Choosing the right coverage ensures that your business can weather unexpected challenges and continue to grow.

General Liability Insurance

General liability insurance is one of the most common and essential forms of business insurance. It provides coverage for third-party claims, including bodily injury, property damage, and advertising injury. For example, if a customer slips and falls at your business premises, this insurance can help cover their medical expenses and protect you from potential legal claims. Similarly, if your advertising inadvertently infringes on another company’s trademark, general liability insurance can help cover the associated legal fees.

1. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

2. https://dalatfarmer.vn/mmoga-the-ultimate-toolkit-for-scaling-operations-in-growing-companies/

3. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

4. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

5. https://dalatfarmer.vn/mmoga-a-comprehensive-guide-to-small-business-insurance/

This type of insurance is critical for almost every business, regardless of size or industry, as it shields you from some of the most common risks you could face during day-to-day operations. Without it, even a minor incident could lead to significant financial strain.

Commercial Property Insurance

If your business owns or leases physical assets like office space, warehouses, equipment, or inventory, commercial property insurance is a must-have. This policy helps protect you against losses caused by theft, fire, vandalism, or natural disasters like storms. Whether it’s a small business or a larger operation, commercial property insurance ensures that your physical investments are safeguarded, allowing you to focus on running your business without worrying about catastrophic damages.

Key Features of Commercial Property Insurance

- Building Coverage

Protects the physical premises of your business, including walls, floors, roofing, and any permanent fixtures like built-in cabinetry. This is ideal for businesses that own their property or are responsible for maintaining leased spaces.

- Contents Coverage

Provides coverage for assets like equipment, furniture, inventory, and other items housed on your property. For instance, if your office computers or inventory are damaged in a fire, contents coverage will help repair or replace them.

Add-Ons to Consider

Depending on your business’s location and specific risks, you may want to consider optional add-ons such as earthquake insurance, flood coverage, or business interruption insurance. Business interruption coverage can be particularly valuable, as it provides financial support to keep your operations running (or to recover lost income) during a period when your business is temporarily shut down due to covered damages.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is designed for businesses that provide professional services or advice. It protects against claims arising from negligence, mistakes, or failure to deliver promised services, which could result in financial losses for your clients.

For example, if a consultant provides incorrect financial advice that leads to a client losing money, this type of insurance can cover legal fees and settlements. Similarly, if a software developer delivers a product with defects that disrupt a client’s business, professional liability insurance would help handle the resulting claims.

Who Needs Professional Liability Insurance?

This type of insurance is particularly important for industries where expertise and specialized services are critical, including:

- Legal and Financial Consulting: Accountants, lawyers, and financial advisors often face high liability risks due to the nature of their work.

- Healthcare Providers: Doctors, therapists, and wellness practitioners need protection against claims of malpractice or negligence.

- Tech Developers and IT Consultants: Errors in software, cybersecurity breaches, or missed deadlines can lead to significant client losses.

Workers’ Compensation Insurance

For businesses with employees, workers’ compensation insurance is not just important—it’s often legally required. This coverage protects both employers and employees by covering medical expenses, rehabilitation costs, and lost wages for workers who are injured or become ill on the job. It also shields employers from lawsuits related to workplace injuries, ensuring smoother resolution of such incidents.

For example, if an employee working in a warehouse suffers a back injury while lifting heavy equipment, workers’ compensation will cover their treatment and any lost income while they recover. This allows the employee to heal without financial stress while protecting the employer from potential litigation.

Workers’ Compensation Requirements by State

Workers’ compensation laws vary widely from state to state, so it’s essential to research your local requirements when searching for “business insurance near me.” Some states require coverage for even a single employee, while others have different thresholds based on the number of employees or industry type. Ensuring compliance with workers’ compensation laws helps you avoid penalties and keeps your business running smoothly.

Why Business Insurance Matters

Having the right mix of business insurance is about more than just meeting legal requirements — it’s about safeguarding your business for the future. From protecting your physical assets to shielding yourself from legal claims, the right insurance policies can help you mitigate risks and focus on what matters most: growing your business. Whether you’re launching a startup, running a small business, or managing a larger company, taking the time to understand your insurance needs can save you time, money, and stress in the long run.

How to Find the Best Business Insurance Near Me

The key to finding the perfect business insurance provider near you is thorough research and diligent comparison shopping. This process involves carefully evaluating your business needs, understanding the types of coverage available, and ensuring the insurer has a strong reputation for reliability and customer service.

1. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

2. https://dalatfarmer.vn/mmoga-a-comprehensive-guide-to-small-business-insurance/

3. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

4. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

5. https://dalatfarmer.vn/mmoga-the-ultimate-toolkit-for-scaling-operations-in-growing-companies/

Evaluate Your Business Needs

Every business faces unique risks depending on its industry, location, and size. Identifying these risks is the first step to ensuring you get the right coverage. Consider the following points:

- What types of claims are most common in your industry? For example, a retail business may need liability coverage for slip-and-fall accidents, while an IT company may require cyber insurance.

- How many employees do you have, and are you complying with local laws for workers’ compensation coverage?

- What is the value of your property and assets, including equipment, inventory, and office space?

- Are there any specific risks tied to your geographic location, such as natural disasters or crime rates?

Understanding your unique risks will guide you toward the necessary types of insurance and appropriate coverage limits. It’s also worth considering whether your business might face risks in the future as it grows or adopts new technologies.

Research Local Providers

Performing a search for “business insurance near me” will yield a list of local insurance agencies and providers. To narrow down your options, take the time to investigate each provider’s offerings, reputation, and track record. Look into their experience working with businesses in your industry, as specialized knowledge can be invaluable.

Questions to Ask Potential Insurance Providers:

- What types of policies do you specialize in, and do you have experience working with businesses like mine?

- How flexible are your coverage options if my business grows or our needs change?

- Can I bundle multiple policies, such as liability, property, and workers’ compensation insurance, for a discounted rate?

- What is your claims process like, and how quickly are claims typically resolved?

- Do you offer online tools or a dedicated representative for managing my policies?

Reading customer reviews and testimonials can also provide valuable insights into the provider’s reliability, customer service, and how well they handle claims. Don’t hesitate to ask for references from other businesses they’ve worked with.

Compare Quotes and Coverage Options

Gathering and comparing quotes from multiple providers is a critical step in finding the best option for your business. While it can be tempting to go with the lowest price, focusing solely on cost can lead to inadequate coverage. Instead, review each policy carefully to ensure it meets your specific needs.

For instance:

- Does the policy cover the full range of risks your business faces?

- Are the coverage limits high enough to protect against worst-case scenarios?

- Are there any exclusions or limitations that might leave you vulnerable?

Take note of how each insurer handles customer service, claim processing, and policy customization. A provider with slightly higher premiums may offer added value through better support, tailored coverage options, or faster claims resolution, which can save you significant headaches down the road.

Additional Tips for Choosing Business Insurance

- Don’t wait until an incident occurs to secure insurance. Being proactive helps ensure your business is fully protected when it matters most.

- Work with an insurance broker if you’re unsure where to start. Brokers can help you navigate the complexities of business insurance and find the best fit for your needs.

- Periodically review your policies to ensure your coverage evolves with your business. As your operations grow or change, your risks and insurance needs may also shift.

By taking the time to evaluate your needs, research providers, and compare coverage options, you can confidently choose the right business insurance provider near you. A well-chosen policy not only safeguards your business from potential losses but also provides peace of mind as you focus on growth and success.

Final Tips for Securing Business Insurance Near Me

Understanding the intricacies of business insurance is essential to ensuring your business has the protection it needs, tailored specifically to its requirements. Business insurance comes in many forms, from general liability and professional liability to property insurance and workers’ compensation, and selecting the right combination of policies can feel overwhelming. This is why working with an experienced insurance agent can make all the difference. An agent can guide you through the process, helping to structure policies that align with your business’s size, industry, and unique risks.

The right business insurance does more than just provide coverage in times of need—it lays the foundation for long-term sustainability and peace of mind. It ensures that your business can weather unexpected challenges, whether it’s property damage, lawsuits, or employee-related claims. By following this guide and seeking trusted providers when searching for business insurance near me, you can confidently safeguard your company’s future while maintaining focus on growth and innovation.

Don’t wait for risks to arise—be proactive. Taking the time now to invest in the right insurance not only protects your business but also gives you and your team the confidence to pursue new opportunities knowing you’re covered. Your business’s future depends on the decisions you make today, and securing comprehensive insurance coverage is one of the smartest moves you can make.