A Comprehensive Guide to Small Business Insurance

Small business insurance is a critical component of any business plan, safeguarding your company from unexpected costs, legal claims, and unforeseen circumstances. Whether you’re an experienced entrepreneur or just starting your small business venture, understanding the types of insurance available and their benefits should be a top priority. This guide breaks down the essentials of small business insurance, including its types, importance, and how to choose the best policy for your needs.

Toc

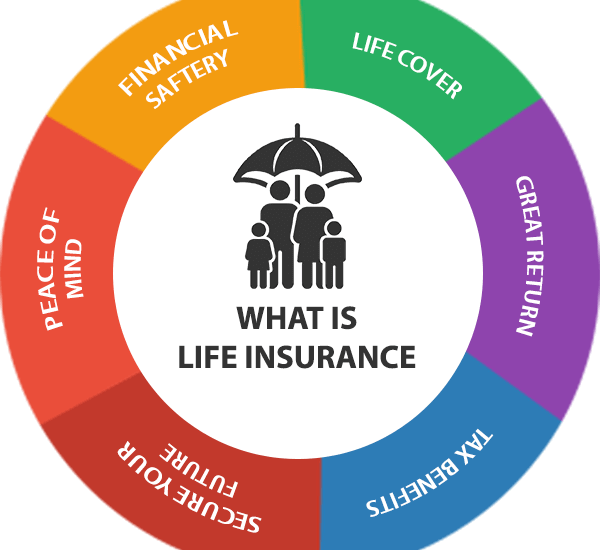

What is Small Business Insurance?

Small business insurance is a specialized type of coverage tailored specifically for businesses with fewer employees and lower revenue than large corporations. It provides critical financial protection against a wide range of risks, such as property damage, liability claims, employee injuries, and even unexpected disruptions like business interruptions caused by natural disasters or other unforeseen events. Without adequate insurance, small businesses may struggle to recover from costly financial losses, which could jeopardize their operations and even force them to shut down.

Types of Small Business Insurance

There are several types of small business insurance, each designed to address specific risks and needs. Depending on the industry, business model, and size of your company, one or more of the following types of insurance may be essential for protecting your business:

General Liability Insurance

General liability insurance is one of the most common types of small business insurance, offering protection from claims related to bodily injury, property damage, or advertising injury caused by your operations, products, or services. For example, if a customer slips and falls in your store or if your marketing inadvertently infringes on another company’s trademark, general liability insurance can cover the associated legal fees, medical expenses, or damages. Without it, businesses could face steep out-of-pocket costs.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is essential for businesses that provide professional services, advice, or expertise. It covers legal fees and settlements resulting from claims of negligence, mistakes, or a failure to deliver promised results. For instance, if a client accuses your business of providing inaccurate financial advice or missing critical project deadlines, this insurance can protect your business from costly lawsuits.

Commercial Property Insurance

If your business owns or leases physical property, such as office space, warehouses, or expensive equipment, commercial property insurance protects those assets from perils like fire, theft, vandalism, or natural disasters. For example, if a fire damages your office or equipment critical to your operations is stolen, this insurance ensures you can repair or replace those assets without suffering severe financial losses.

Workers’ Compensation Insurance

Workers’ compensation insurance is legally required in most states for businesses with employees. It covers medical expenses, lost wages, and rehabilitation costs for employees who are injured on the job. Additionally, it provides death benefits to families in the unfortunate event of a work-related fatality. For example, if an employee gets injured while operating machinery, workers’ compensation ensures they receive proper medical care and financial support without the need for legal disputes.

Business Owner’s Policy (BOP)

A BOP is a bundled insurance package that combines general liability, commercial property, and other forms of coverage into one comprehensive policy. This option is often more affordable and convenient than purchasing individual policies. It is particularly beneficial for small businesses that face multiple risks but want to simplify their coverage and reduce costs. For instance, a small retail store owner might use a BOP to cover both property damage and customer liability claims under one policy.

Why You May Need Small Business Insurance

No matter the industry, every business faces inherent risks. From an accident on your property to a data breach affecting your customers’ personal information, there are countless scenarios that could lead to unexpected costs. Small business insurance serves as a safety net, ensuring that one adverse event doesn’t derail your entire operation or result in irreparable financial loss.

1. https://dalatfarmer.vn/mmoga-comprehensive-guide-to-finding-the-best-business-insurance-near-me/

2. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

3. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

4. https://dalatfarmer.vn/mmoga-the-ultimate-toolkit-for-scaling-operations-in-growing-companies/

5. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

Moreover, carrying insurance is often a sign of professionalism and reliability. Many clients, landlords, and business partners require proof of specific types of insurance as part of contractual agreements. For example, a landlord might demand commercial property insurance before leasing office space, or a client might expect professional liability insurance before signing a project contract. Having the right insurance not only protects your business but can also open doors to new opportunities and partnerships, contributing to long-term growth and success.

In the fast-paced world of entrepreneurship, safeguarding your business with the right insurance is an investment in its stability and future. By understanding and choosing the coverage that aligns with your unique needs, you can focus on growing your business with peace of mind, knowing you’re prepared for whatever challenges come your way.

The Importance of Small Business Insurance

The importance of small business insurance cannot be overstated. It plays a critical role in protecting not only your assets and reputation but also in ensuring your business can continue operating despite unexpected challenges. Many business owners often underestimate the likelihood of risks such as lawsuits, natural disasters, or cyber threats—risks that can strike at any time and potentially lead to major financial strain without the right coverage in place. Small business insurance is the safety net that allows you to focus on growth and innovation, knowing you’re prepared for whatever may come your way.

Key Benefits of Small Business Insurance

Financial Peace of Mind

Running a business comes with inherent risks, and unexpected expenses like property damage, legal fees, or liability claims can disrupt your financial plans. Small business insurance provides a safety net, covering these costs and offering financial stability. With this peace of mind, you can focus on scaling your business and investing confidently in new opportunities, knowing that you’re prepared for unforeseen setbacks.

Legal Compliance

Certain types of insurance, such as workers’ compensation or liability insurance, are legally required for businesses in most states. Failing to comply with these regulations could result in hefty fines or legal actions that harm your business. Having the proper coverage ensures compliance with labor laws and shields your business from potential penalties, allowing you to operate without fear of legal repercussions.

Customer and Partner Trust

Carrying insurance is a sign of professionalism and responsibility. It builds trust among your clients, partners, and investors, who feel reassured knowing you have a plan in place to handle potential risks. In fact, many contracts and partnership agreements may require proof of specific insurance policies before proceeding. This not only helps you secure valuable opportunities but also strengthens your reputation as a reliable and trustworthy business.

Employee Protection

Your employees are the backbone of your business, and protecting their well-being is crucial. Workers’ compensation insurance and health coverage are not just legal requirements in many cases—they’re also a way to show employees you value their contributions. Providing these protections improves employee morale, enhances loyalty, and reduces turnover, which ultimately benefits your business by fostering a productive and dedicated workforce.

Real-Life Scenarios Where Insurance Matters

Unexpected incidents can happen at any time, often when you least expect them. Imagine a customer slipping and falling in your store, resulting in a medical claim. Without liability insurance, you could be responsible for covering medical expenses, legal fees, or even compensation claims, which could put a significant dent in your finances.

Now consider a scenario where your business property is damaged by a fire. The cost of repairs, replacement of equipment, and disruptions to daily operations could be devastating without a commercial property insurance policy to cushion the blow.

Or think about the growing threat of cyberattacks. A data breach could expose sensitive customer information, leading to costly recovery efforts and potential lawsuits if you’re found liable. Cyber liability insurance helps cover these expenses, safeguarding both your finances and your reputation.

In all these cases, small business insurance ensures continuity and resilience, allowing you to tackle challenges head-on without jeopardizing your business’s future. It’s not just about protecting your business against financial losses—it’s about empowering your business to thrive, no matter what obstacles come your way.

1. https://dalatfarmer.vn/mmoga-the-ultimate-handbook-on-financial-planning-for-entrepreneurs/

2. https://dalatfarmer.vn/mmoga-comprehensive-guide-to-finding-the-best-business-insurance-near-me/

3. https://dalatfarmer.vn/mmoga-the-role-of-liability-coverage-in-protecting-your-enterprise/

4. https://dalatfarmer.vn/mmoga-the-ultimate-toolkit-for-scaling-operations-in-growing-companies/

5. https://dalatfarmer.vn/mmoga-understanding-business-insurance-liability/

How to Choose the Right Small Business Insurance

Choosing the right small business insurance is crucial for protecting your business from unexpected risks and ensuring long-term stability. The type of insurance you need depends on several factors, such as the size of your business, the industry you’re in, and the specific risks you may face on a day-to-day basis. With so many options available, the process of selecting the right coverage can feel overwhelming, but a step-by-step approach can simplify it and help you make the best decision for your business.

Steps to Evaluate Your Insurance Needs

Assess Your Business Risks

Every business faces unique risks based on its industry and operations. Identify potential liabilities that could impact your business. For example, a construction company may need comprehensive liability and property coverage due to the physical risks involved in daily operations, while a digital marketing agency may prioritize coverage for cybersecurity and errors & omissions. Think about factors like employee safety, customer interactions, and the physical assets of your business.

Understand State Requirements

Each state has its own legal requirements for small business insurance. For instance, most states require workers’ compensation insurance if you have employees, and some may mandate additional types of coverage depending on your industry. Failing to meet these legal requirements can lead to penalties, fines, or even lawsuits, so it’s important to research what’s mandated in your state and ensure compliance.

Consult a Professional

Insurance can be complicated, so it’s a good idea to work with an experienced insurance agent or broker. They can help you identify the policies best suited to your specific needs and budget. A professional can also explain the nuances of various types of coverage, ensure you’re not underinsured, and help you avoid paying for unnecessary extras. Their expertise can save you time and money while ensuring you’re fully protected.

Review Policy Details Carefully

Before committing to a policy, take the time to thoroughly review its terms and conditions. Pay close attention to the coverage limits, deductibles, and any exclusions. These details can significantly impact your coverage in the event of a claim. For example, some policies may exclude damage caused by natural disasters, while others may not cover certain types of equipment. Understanding these details ahead of time ensures you won’t be caught off guard when you need to file a claim.

Questions to Ask Before Purchasing Coverage

Choosing the right insurance isn’t just about ticking boxes—it’s about ensuring your business is adequately protected. Here are some essential questions to ask before committing to a policy:

- What are the deductible amounts, and how much will I need to pay out of pocket before coverage kicks in?

- Are there any exclusions or limitations that could leave my business vulnerable in specific situations?

- Does this policy provide coverage for all aspects of my business operations, including new services or products I may offer in the future?

- Can the policy scale with my business as it grows, so I don’t have to switch providers or purchase additional policies later?

- Are there any discounts or bundles available if I purchase multiple policies?

By thoroughly understanding your risks, researching state requirements, seeking professional advice, and reviewing policy details, you can make an informed decision about your small business insurance. Taking the time to evaluate your needs not only protects your business but also prevents you from overpaying for unnecessary coverage. With the right policy in place, you can focus on growing your business with peace of mind, knowing that you’re prepared for whatever challenges may come your way.

Conclusion

Small business insurance is both a necessity and an investment in the future of your enterprise. It safeguards your business from unexpected challenges, including property damage, liability claims, or even employee-related incidents. Protecting your assets, employees, and reputation ensures your business can continue to operate and thrive even in times of uncertainty. With so many coverage options available—such as general liability, workers’ compensation, and business interruption insurance—it’s important to evaluate your unique risks and industry requirements. Take the time to understand your specific needs, thoroughly research your options, and seek professional guidance from an insurance expert to secure the best coverage for your small business. By having the right insurance in place, you can run your business with confidence, knowing you’re prepared for the unexpected. This allows you to focus on what you do best—building, innovating, and growing your company.